net operating working capital turnover

Net annual sales divided by the average amount of working capital during the same year. Working capital is current assets minus.

Operating Working Capital Owc Financial Edge

If the company has 1 million in outstanding long-term debt on its books we can subtract this amount from its total liability.

. The working capital turnover ratio is a measure. Example of Working Capital Turnover Ratio To illustrate the working capital turnover ratio lets assume that a companys net sales for the most recent year were 2400000 and its average amount. Operating Assets net 10 million 4 million 6 million.

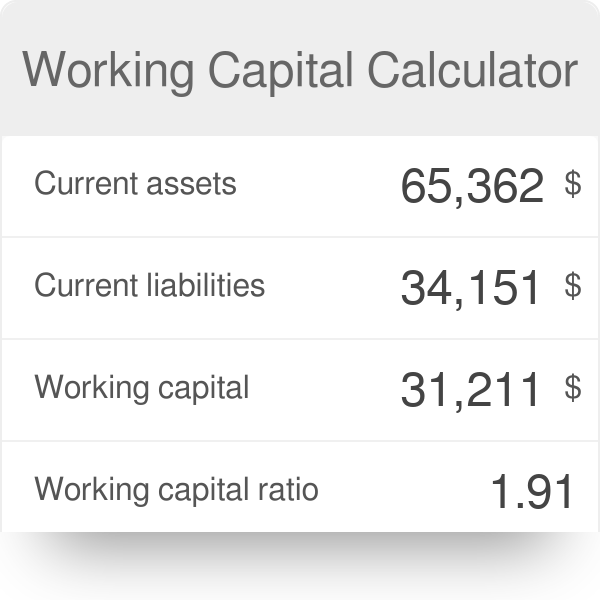

You can monitor the Working Capital Turnover Ratio to make sure you are optimizing use of the working capital. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. The working capital turnover refers to a companys ability to convert its short term assets into cash to fund business operations.

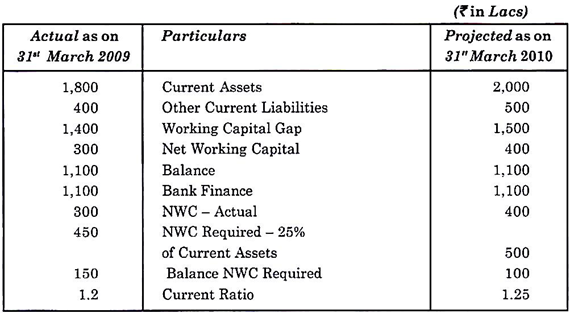

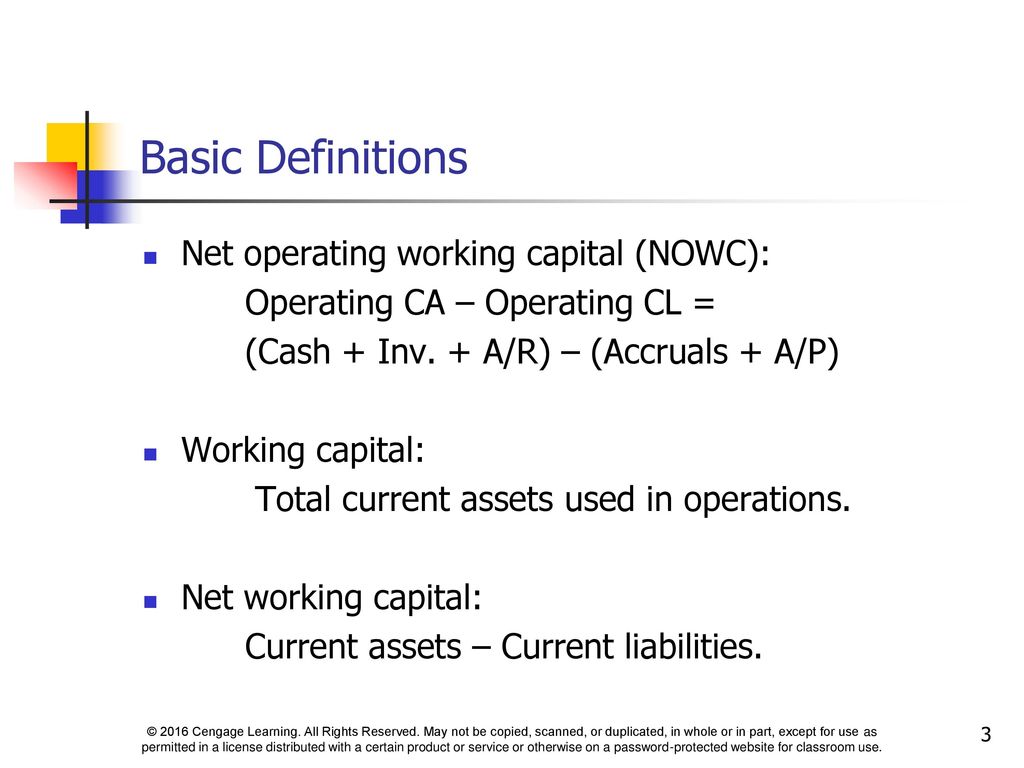

Net Operating Working Capital Turnover Net operating working capital is equal to from ACCOUNT MISC at University of National Development Veteran Yogyakarta. Working capital turnover Net annual sales Working capital. The net operating working capital or NOWC is the value in excess of a companys operating current assets over the operating current liabilities.

This metric is much more tied to cash flows than the net working. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business.

Venture Debt is a financing structure similar to that of a traditional bank loan. In this formula the working capital is calculated by subtracting a companys current liabilities from its current. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities.

A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. It requires fixed monthly interest. Working Capital Turnover Ratio.

More Current Ratio Explained. How to Calculate Working Capital Turnover. Operating current assets are.

The working capital turnover ratio is calculated as follows. Revenue-Based Financing provides company with working capital in exchange for a percentage of future monthly revenue. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this.

Published October 12 2015. Once you know your working capital amount divide your net sales. How to Calculate Operating Working Capital Step-by-Step The traditional textbook definition of working capital refers to a companys current assets minus its current liabilities.

If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. The working capital turnover compares a companys net sales to its net working capital NWC in an effort to gauge its operating efficiency.

Normal Level Of Net Working Capital At Closing Divestopia

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

Chapter 7 Working Capital Management

Working Capital Formula How To Calculate Working Capital

How To Calculate Working Capital Turnover Ratio Flow Capital

6 Working Capital Turnover Ratios Youtube

What Is The Working Capital Turnover Ratio And How Is It Calculated

What Is The Working Capital Turnover Ratio And How Is It Calculated

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Supply Chains And Working Capital Management Ppt Download

May 2018 Project Management Small Business Guide

Working Capital Turnover Ratio Formula Example And Interpretation

:max_bytes(150000):strip_icc()/workingcapitalmanagement_definition_final_0915-38c4dcf92b92461283ad2fe0a644697e.png)